Remita: All You Need to Know

We have many electronic payments in Nigeria. These electronic payment channels have become a blessing in providing financial services to businesses and individuals. Transferring money, receiving money, and paying bills have improved greatly because of e-payments.

Remita is one of the best on the list of e-payments channels that we have in Nigeria. Consequently, this will be our focus in this post as you will get tangible information about the platform in this post.

Advertisement

Also, read All You Need to Know about Taxpayer Identification Numbers.

Remita

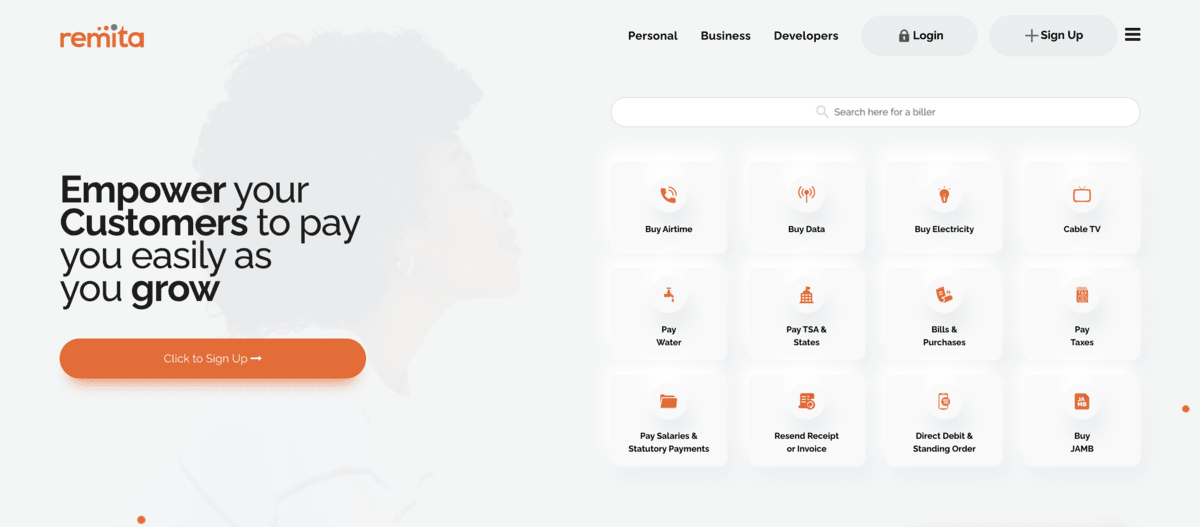

Remita is an e-payment platform that performs all the main functions of electronic payment and more. You can transfer money, receive money, pay bills, pay taxes, and even salaries with Remita.

The platform is one of the best electronic payments among other platforms in Nigeria. Individuals, governments, and small and large businesses use Remita because the platform is efficient, fast, secure, and easy to use.

The platform was created in 2005, and founded by John Obaro who is the present chairman of the company. The platform is managed by SystemSpecs and has its headquarters in Lagos.

However, Remita is not only operational in Nigeria, it has spread its wings across Africa providing solutions to financial services and digital payments. Ghana, Sierra Leone, and Kenya are examples of the countries where the operations of Remita have reached.

Advertisement

What can you do with Remita?

Similar to other e-payment platforms, Remita can be used to perform a whole lot of personal and business transactions using the website or the mobile app. Some of the transactions that you can perform on the platform include:

- Transfer of money to other banks/customers

- Receive money

- Pay bills

- Salary payment services

- Pay school fees

- Payment of taxes and pension

- Generate Invoice for accepting payment

- Manage multiple bank accounts

- Track Payments

- Generate receipts for payments

- Budgeting (Tracking income and expenditure)

- Create a payroll system (for businesses)

- Make or Accept Installment Payments (the customer and supplier agrees)

With Remita, you can receive payments through the following preferred payment channels:

- Debit/Credit Cards

- POS (Point of Sale)

- Mobile Wallets

- Internet Banking

- USSD

- Bank Offices/Branches

- Remita Account

Also, read All You Need to Know about Asset Management.

Creating an account with Remita

You can become a user of the platform by signing up on the app or the website. Remita has different registration for different users. You can create personal accounts and business accounts and there is also a special account for government organizations.

The process for registration is easy and can be completed in no time as long as you have all the required information. The whole process can be summarised in the following steps.

Step 1

Visit the Remita website and click on the “Sign Up” button. Also, you can use the App to begin your registration process (Remita App is available on Google Play Store and App Store)

Step 2

Choose the type of account you want. Fill in the required personal and company details depending on the type of account you choose

Step 3

The next step is to create a unique username and password for your account. Ensure the password is secured and is something that you can easily remember

Step 4

You will receive a verification email through the provided email. Follow the instructions in the email sent to complete the verification process.

Step 5

Complete the account setup process by providing additional information and completing the required KYC (Know Your Customer) documentation.

You now have a Remita account after the last step and the validation of the KYC documents provided. Furthermore, remember that the process and requirements for registering a Remita account may vary based on your location and the type of account you want to open

Remita Retrieval Reference

You need to be familiar with the term RRR if you want to use Remita. RRR is the shorthand of Remita Retrieval Reference, it is a unique set of numbers generated for you to make transactions when using Remita. You can also use the RRR to retrieve your receipt or invoice for transactions that you perform on the platform.

How to generate Remita Retrieval Reference (RRR)

Once you have an account with Remita, generating RRR is easy, however, if you do not have an account on the platform then you might just need to have to open one before you can generate RRR. RRR is only generated when you want to make a payment and does not expire after generation.

Perform the following steps to generate RRR on either the website or the app:

- Log in your details on the website or the app.

- Select the “Pay” option. Note that each payment option has its information and process. Paying to an individual, business or government treasury account has a different interface and information to be supplied.

- Fill in the necessary details, including the payee’s name, email, phone number, and every other information needed.

- State the purpose of the transaction.

- Choose the payment method (e.g. bank transfer, debit/credit card, USSD, etc.).

- Review and confirm the transaction details.

- An RRR will be generated and displayed on the screen. It is advisable to copy down the RRR for safekeeping and future use. You can as well copy and save it on your phone or take a screenshot of it.

- Generating your RRR enables you to proceed with making payment.

Banks that accept Remita

The following is a list of the banks and fintech organizations that accept Remita as a means of payment.

Banks

The following is the list of the banks that accepts Remita as a mode of payment:

- Access Bank

- Ecobank Nigeria

- Fidelity Bank

- First Bank of Nigeria

- Guaranty Trust Bank

- Heritage Bank

- Keystone Bank

- Polaris Bank

- Stanbic IBTC Bank

- Sterling Bank

- Union Bank of Nigeria

- United Bank for Africa

- Wema Bank

- Zenith Bank

Fintech

- Flutterwave

- Paystack

- Paga

- OPay

- Carbon

- Kuda

- Chipper Cash

- VoguePay.

Paying Bills With Remita

You can pay bills with Remita conveniently and easily from anywhere in Nigeria. The platform has a wide range of billers that you can choose from which makes it a great platform to use. To pay bills, follow the following process:

- Login to your Remita account

- Select the “Pay Bill” option

- Enter the biller details, including the biller code and your account number

- Confirm the bill details and enter the amount to be paid

- Fill in the purpose of your transaction

- Review and confirm the payment

- Complete the payment using your preferred payment methods, such as a bank transfer or debit/credit card

Note: It is important to ensure that you are paying the correct biller, as payments made on Remita are not reversible. Also, you will need to generate an RRR to pay the bills

Remita Loan

Remita Loan is a loan service provided by Remita, a leading financial technology company in Nigeria. In addition, Remita partnered with payday, paylater, cash connect, and other loan companies to disburse loans.

The eligibility criteria for a Remita Loan may vary depending on the loan product and the lender’s policies. However, some common eligibility criteria include:

- Age: Must be 18 years or older

- Residency: Must be a Nigerian resident

- Income: Must have a regular source of income

- Employment: Must be employed, self-employed, or a business owner

- Credit history: Must have a good credit score

- Bank account: Must have a valid and active bank account

- Identity: Must provide a valid form of identification, such as a passport, driver’s license, or national ID card.

Note: These eligibility criteria are subject to change and may vary based on the lender’s policies. Please check with the lender directly for the most up-to-date information on loan eligibility.

Final Notes on Remita

Remita is a great platform to choose when you want to use an e-payment channel for your financial services. There are many services that you can enjoy when you use the platform.

The platform is popular, easy to use, and open to individuals, businesses, and the government. You can use Remita by downloading the app or using the website.

Before you go, check out Union Bank USSD Code.

One Comment

Comments are closed.