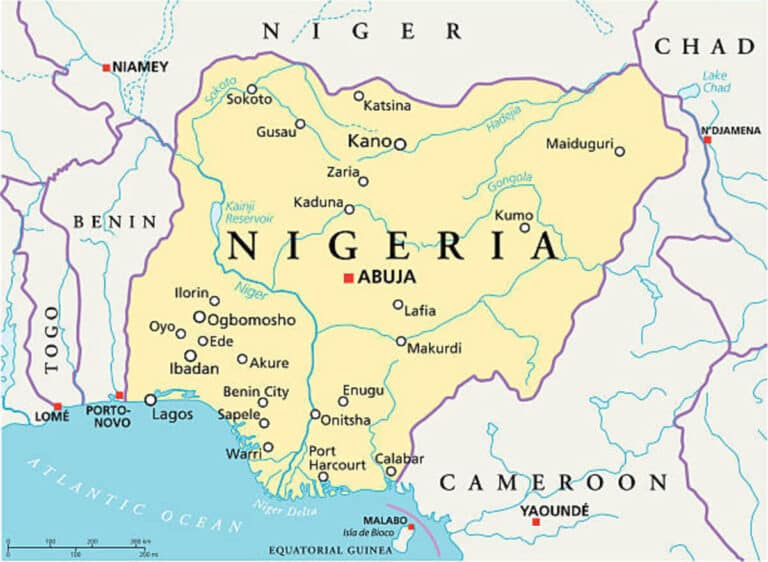

Grants for Businesses in Nigeria

Every business owner’s dream is to expand and scale their business, but lack of funding can be a stumbling block to this progress. The lack of funding reduces the full potential of the business.

Irrespective of the business you are running- small or large business- there is always a funding option for your business, and this is where business grants and business loans come in.

These funding options can go a long way to help a business grow right from the inception of the business idea to become a well-recognized business.

Advertisement

Also, check out The Nigerian Stock Exchange.

Business Grants

Business Grants are a funding option given by public or private entities to grow and expand individual businesses for support without necessarily having to pay back.

Small business grants are often given for a particular purpose, which could ease the effect of unemployment or encourage innovation, production, and industrialization.

Grants are often developed to serve a social purpose to a community. However, the culture of receiving grants can also impair the same community it is meant to serve, mainly when the entrepreneurial drive solely depends on grants and not on innovation.

Advertisement

Business loans

A loan is a financial capital, i.e.,i.e.ney borrowed from a financial institution. A loan must be repaid by the business owner, after a specific period, with a certain amount as interest. The giver, in this case, is known as the lender, while the recipient is known as the borrower.

Differences between Business Grants and Business loans

Payment

Grants are issued without a motive that they should be paid back, unlike loans that require a payback and even with interest and at a particular time.

Collateral

Collateral is what loan organizations take over once the loan is not paid back. It is usually a requirement before one can be issued a loan.

Availability

Loans are available, while Grants might be available for some time.

However, a grant is a preferable option for Business funding as it is very competitive because it may seem like a gift and nonrefundable. Still, it comes with some result that is expected to be delivered. Therefore some things should be checked before applying for it:

Eligibility

It is very pivotal that you check if you are eligible for the grants, and this can be checked on the organization’s website. Some grants are limited to the location of the business, while some are limited to the scope of the business.

Requirements

Some grants may have specific requirements before you can access such as Years of business and some documents that will be needed. You should check the requirements and get the ones you do not have before applying.

Purpose

You must have a convincing Motive for wanting the grants. Why do you want the grants? How is your business idea relevant to the ever-evolving world? , and how will the grants help?

Grants are given to people that the giver or organization believes will maximize and make a significant impact.

Also, check out How Bloggers Generate Revenue.

Places To Get Grants For Businesses In Nigeria

Businesses in Nigeria can get grants in so many places, including internationally. Here are some of the best places for grants for small businesses in Nigeria:

Tony Elumelu Entrepreneurship Programme (TEEP)

This is owned by Nigeria’s business tycoon -Tony Elumelu- it was launched in 2015 and has been running yearly for the support and expansion of business ideas.

It is a 3 million naira seed funding for entrepreneurs across Africa. Applications are being reviewed by Business experts, after which 1000 applicants are selected from the pull of over 50,000 Applicants.

Eligibility

- Business must be based in Africa.

- Business must be for profit

- Business must be 0-3 years old

- Applicants must be 18 or legal residents of African countries.

International Monetary Fund (IMF)

They give grants to non-profit organizations that help the poorest and weakest emerge from their low-income, socially dependent, dangerous, and dysfunctional circumstances.

The IMF gives grants which also focus primarily on fostering economic independence through education and economic development, and it also works to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world

The average grant award is $10,000.

Bank of Industry (Boi)

is a public institution to empower Nigerian entrepreneurs. They founded a program called Youth Entrepreneurship Support (YES).

The YES initiative was established to undertake the rate of unemployed in the country, equip young entrepreneurs with relevant skills needed to kick off a business of their own, and therefore increase self-employment

Eligibility

- You must be a Nigerian citizen

- Have a significant business idea. It is small business friendly as you must only have a significant idea.

- Must be between the ages of 18-35

- Have a minimum education qualification of OND

- All applications will be made online, with you submitting relevant identification documents for verification.

The Bank of Industry also has a Graduate Entrepreneurship Fund (GEF), which is meant to serve members of the National Youth Service Corps (NYSC). Candidates are to submit their business ideas, which a team of professionals will then review.

Selected Corp Members, whose businesses are marketable and bankable, are trained for four weeks and given between N500,000 and N2,000,000.

YouWiN Connect Nigeria

This is a multimedia program of the federal ministry of finance. This is a youth development scheme to empower Nigeria youths by providing grants to small business owners.

It is run as a competition, where entrants submit their business plan for a registered business with the Corporate Affairs Commission in Nigeria and are evaluated by the Enterprise Development Center of Pan-African University.

This is a private and public initiative program that finances outstanding business plans for young entrepreneurs in Nigeria, but the applicants are not just picked randomly. The applicants must be eligible for the program.

Eligibility

- Applicants must be a graduate of a higher institution

- Applicants must b÷ between the age of 18 and 40.

- The applicant must be a Nigeria citizen and also a resident of Nigeria

- Applicants must not be an employee of Nigeria civil service

- Applicants must be willing to attend all training and Mentoring exercises organized by the program.

- Previous YouWin Awardees are not eligible to apply.

Conclusion

Getting grants is one of the activities pivotal to the growth of businesses, new and upcoming businesses. The article examines what business grants entail and provide the distinction between them and business. In addition, the post contains areas or places to source for one.

Before you go, check out How to Start an Online Business.

3 Comments

Comments are closed.