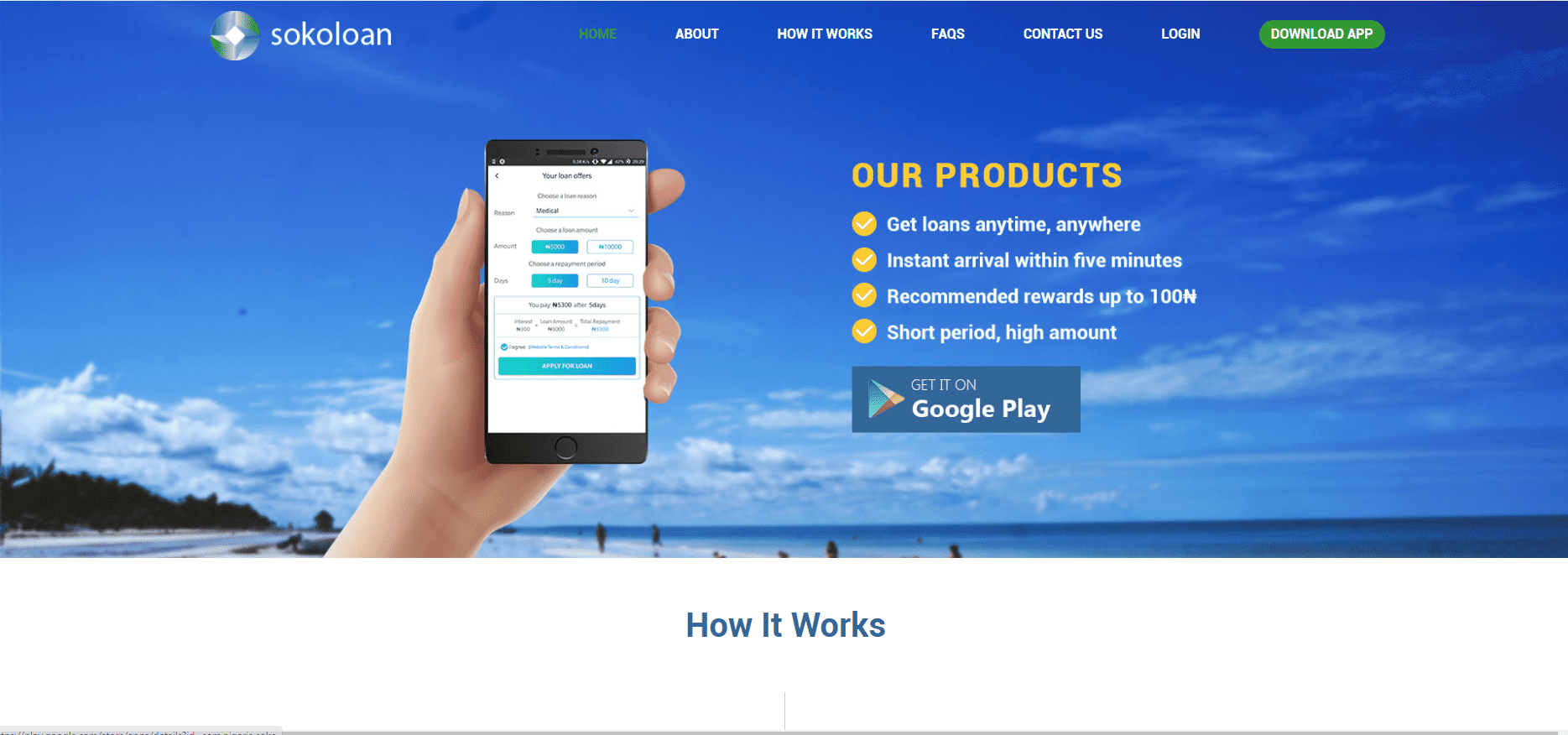

Sokoloan App: All You Need to Know

This article highlights everything you need to know about Sokoloan App. Also, it discusses the terms and conditions of Sokoloan.

Short-term loans are available from Sokoloan, a straightforward online lending platform in Nigeria, to help with unforeseen expenses and cash flow issues.

Sokoloan is accessible every day of the week, around the clock. You can apply for a loan using their quick application form, and you’ll find out the status of your loan in a matter of minutes.

Advertisement

Also, check out All You Need to Know about Fint Loan.

We’ve all witnessed the sudden rise in urgent needs, which is typically followed by challenging loan applications.

Commercial banks frequently experience this challenge because of the extensive paperwork and collateral requirements they have. Run to Sokoloan if you need a quick, simple, and straightforward loan.

Sokoloan Loan Terms and Conditions

- You must be at least 18 years old.

- Also, You must be a Nigerian national.

- You must own a smartphone.

- And that’s it!

Features of the Sokolon App

With the help of Sokoloan App, you can apply for a loan at any time. It supposedly takes 5 minutes to approve a loan, despite what they claim.

You will receive N100 if your loan is approved. With its round-the-clock security, it is dependable and your data is secure.

How does Sokoloan work?

On Sokoloan, you can obtain a loan between $5,000 and $100,000. But keep in mind that on your first try, you will only be given a modest loan. If you pay it back on time, you’ll get more money.

The amount you receive may be influenced by additional factors. The duration of the loan is between 7 and 190 days.

You should be made aware of this prior to submitting your application. You can use your ATM card to pay back your loan. Your debit card information must be entered when you apply for a loan in your profile.

Your credit card will be charged for the loan when it’s due. Fund your account, launch the app, and then complete the payment. Make a prompt call to their customer service if you experience any issues.

When your loan is due, you won’t be able to change the date. The payment must be made by the deadline. Contact their customer service if you are experiencing any problems.

If you want to pay off a loan early, open the Sokoloan app, select the “My Loans” tab, and then tap “Make Repayment.” It is best to apply for a loan that you can repay within the allotted time period because you cannot change the date of your loan.

Remember that if you pay off your loan early or on time, you’ll be eligible for a loan with a higher credit limit when you apply for it again.

Advertisement

Also, check out All You Need to Know about Creditville Loan.

What Documents are Needed to Apply for Sokoloan?

To get a loan from Sokoloan, you do not need to fill out any paperwork. It can only be purchased online. You only need a valid form of identification and your bank account information.

The following are the loan requirements:

- A valid bank account number

- Your Bank’s Verification Code (BVN)

- Your contact information

- A method of identifying yourself

- ATM card that is valid

- You must be employed or self-employed.

How do I get Sokoloan?

If you want to apply for a Sokoloan loan, follow these steps:

- You must first access the Sokoloan mobile app: To receive a loan, you must first download the app. A loan can only be obtained through the mobile app. Go to your smartphone’s Google Play Store, search for the Sokoloan app, and then install it.

- Sign up: Once you’ve downloaded the Sokoloan app, all you have to do is sign up. Simply click on sign up, follow the on-screen instructions, and then enter your information in the registration details.

- Apply for a loan: Once you’ve completed your registration, simply apply for a loan. Go to the app, choose your desired loan option, and wait for a loan offer.

- Send in your application and await a response: Submit your application if you are satisfied with the loan offer, expected repayment date, and all other important details. Following that, you will have to sit tight for a loan decision. This shouldn’t take long at all.

How Reliable is Sokoloan?

Sokoloan is a reputable loan provider. People are only unhappy with their extraordinarily exorbitant interest rates, which range from 4.5 percent to 30 percent. Otherwise, it’s a good way to get small loans speedily, particularly if you need cash quickly.

What is the interest rate of Sokoloan?

Sokoloans have interest rates that range from 4.5 percent to 35 percent. Your connected bank account will be debited when your loan is due in full. The app can be used to pay back the loan early.

However, you should be aware that your repayment date cannot be altered. As a result, it is suggested that you only obtain a loan if you have a repayment strategy in place.

Defaulters are reported to the National Credit Bureau, which affects your credit score.

Sokoloan App

The Sokoloan app can only be downloaded from the Google Play Store. You must have an Android OS version of 4.2 or higher in order to install it.

With more than a million downloads and an average rating of 4, it’s safe to say that users are content with the app overall. For iOS (iPhone) users, there isn’t a single app available right now.

How do I delete my Sokoloan account?

You can either simply follow the instructions below or decide to send a deletion request to SokoLoan customer support:

- Go to your email app, select “Compose,” give your email the subject line “Request to Delete SokoLoan Account,”

- and then type out your request to delete your account.

- Send the letter after it has been written to sokolending@gmail.com. That’s it.

How do I contact Sokoloan?

The headquarters of the company are located at 9, Acme Road, Agidingbi Ikeja, Lagos.

01-4536792 or 08148799371 is the customer service phone number.

Contact customer service at admin@sokoloan.com or sokolending@gmail.com.

Final Notes on All You Need to Know about Sokoloan App

There has been a noticeable change; the ease with which loans can now be obtained has greatly surpassed prior experiences. With less paperwork to complete and from the convenience of your home, getting a loan is a little simpler.

Having said that, you might require an urgent loan to cover an expense or finance a project you are working on, both of which can be taken care of with a single bootstrap.

As more companies have entered the market to offer loans to Nigerians, it appears that the Central Bank of Nigeria is succeeding in achieving its goals for financial inclusion.

If you have any questions, don’t forget to drop them in the comments section below.

Before you go, check out All You Need to Know about Renmoney.

One Comment

Comments are closed.