Opay App Borrowing Made Easy: A Step-by-Step Guide

Are you tired of the long and tedious process of borrowing money? Look no further than the Opay app! With just a few clicks, you can access hassle-free and easy borrowing. As a highly skilled assistant in the digital marketing industry, I understand the importance of efficient and convenient financial services. In this step-by-step guide, I will take you through the simple process of borrowing money through the Opay app. From downloading the app to receiving your funds, I will provide you with all the information you need to make borrowing stress-free. Whether you need money for an emergency or a personal expense, the Opay app’s borrowing feature offers a quick and easy solution. So, let’s dive in and discover how Opay app can make borrowing a breeze!

Also, check out Top Providers of Loans Without BVN in Nigeria.

Advertisement

Understanding Opay App’s borrowing feature

Opay app is a digital payment platform that also offers a borrowing feature. This feature allows users to borrow money instantly without the need for collateral or paperwork. The app is available on both iOS and Android devices, making it accessible to a wide range of users. Opay app’s borrowing feature is powered by OKash, a lending platform that is backed by Opera Software, a leading internet company. With OKash, you can borrow between ₦1,500 ($3.87) and ₦50,000 ($128.95) with interest rates ranging from 5% to 36%. The loan repayment period is between 91 and 365 days, depending on the loan amount.

Benefits of using the Opay App for borrowing

Opay app’s borrowing feature offers a range of benefits to users. First and foremost, the process of borrowing is quick and easy, with funds being disbursed within minutes of approval. The app also offers flexible repayment options, allowing users to repay their loans in installments or in full at any time. Additionally, the Opay app’s borrowing feature is available 24/7, making it convenient for users who need money urgently. Unlike traditional lending institutions, the Opay app does not require collateral or a guarantor, making it accessible to a wider range of users. Finally, the Opay app’s borrowing feature is transparent, with no hidden fees or charges.

Also, check out Zedvance Loan USSD Code.

Advertisement

How to download and set up Opay App

To access the Opay app’s borrowing feature, you will need to download and set up the app on your device. Here’s a step-by-step guide to downloading and setting up the app:

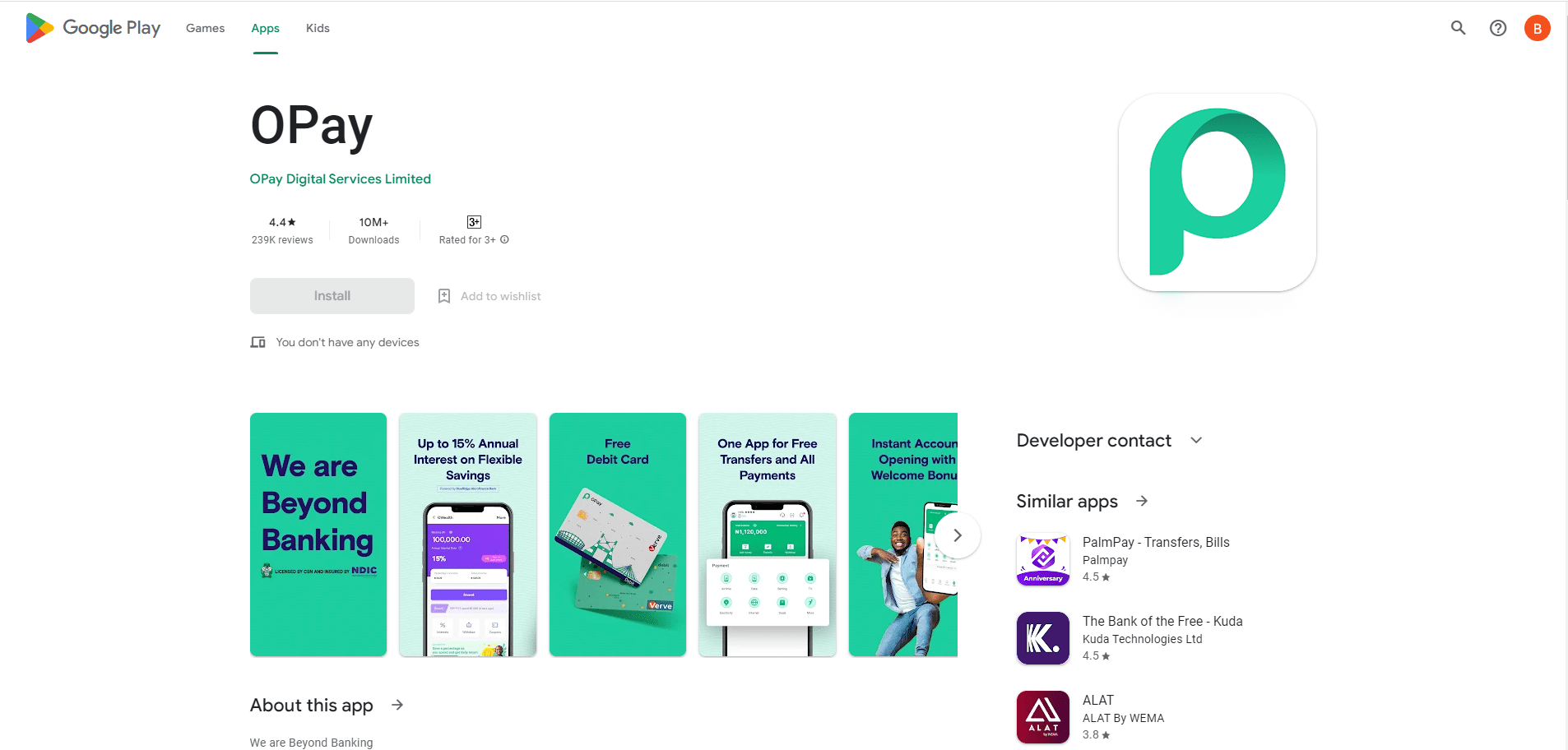

- Visit the Google Play Store or the Apple App Store on your device.

- Search for “Opay” and select the Opay app from the search results.

- Click on the “Install” button to download and install the app on your device.

- Once the app is installed, open it and click on the “Register” button to create an account.

- Follow the on-screen instructions to enter your personal details and create a password.

- Once your account is set up, you can access Opay app’s borrowing feature.

Eligibility requirements for borrowing on Opay App

To be eligible for borrowing on Opay app, you must meet the following requirements:

- You must be a Nigerian citizen or resident.

- You must be between 18 and 55 years old.

- You must have a valid means of identification (e.g. National ID card, driver’s license, international passport).

- You must have a steady source of income (e.g. salary, business income).

- You must have a bank account with a Nigerian bank.

A step-by-step guide to borrowing on Opay App

Now that you have set up your Opay app account and met the eligibility requirements, you can start borrowing money. Here’s a step-by-step guide to borrowing on Opay app:

- Open the Opay app and click on the “Borrow” button on the home screen.

- Select the loan amount you need and the repayment period.

- Enter your personal details, including your name, phone number, and email address.

- Enter your bank account details, including your account number and name of the bank.

- Review the loan terms and conditions and click on the “Apply” button to submit your loan application.

- Wait for your loan application to be processed. This usually takes a few minutes.

- Once your loan is approved, the funds will be disbursed to your bank account immediately.

Repaying your Opay App loan

Opay app’s borrowing feature offers flexible repayment options to users. You can choose to repay your loan in installments or in full at any time. To repay your loan, follow these steps:

- Open the Opay app and click on the “Repay” button on the home screen.

- Enter the loan amount you wish to repay and select your preferred repayment method.

- Follow the on-screen instructions to complete your repayment.

Tips for successful borrowing on Opay App

Here are some tips to ensure successful borrowing on Opay app:

- Only borrow what you can afford to repay.

- Repay your loans on time to avoid late fees and penalties.

- Keep your personal and bank account details up-to-date.

- Contact Opay app’s customer support if you have any questions or concerns.

Opay App borrowing FAQs

- Is Opay app’s borrowing feature safe and secure?

Yes, Opay app’s borrowing feature is safe and secure. The app uses SSL encryption to protect your personal and financial information.

- How long does it take to receive loan approval?

Loan approval usually takes a few minutes, and funds are disbursed immediately upon approval.

- What happens if I am unable to repay my loan?

If you are unable to repay your loan, you may be charged late fees and penalties. Additionally, your credit score may be negatively affected, making it harder to borrow in the future.

Conclusion

Opay app’s borrowing feature offers a quick and easy solution to your financial needs. With just a few clicks, you can access hassle-free and easy borrowing. From downloading the app to receiving your funds, this step-by-step guide has provided you with all the information you need to make borrowing stress-free. Remember to borrow responsibly and only what you can afford to repay. If you have any questions or concerns, don’t hesitate to contact Opay app’s customer support.

Before you go, check out Loans for Salary Earners in Nigeria.

One Comment

Comments are closed.